georgia property tax exemption codes

Homestead Exemption Codes - Schneider Corp. State and federal government websites often end in gov.

STATE of GEORGIA and LOCAL HOMESTEAD EXEMPTIONS EX Code AMOUNT DESCRIPTION State Code Description.

. The additional sum is determined according to an index rate set by United States Secretary of Veterans Affairs. The administration of tax exemptions is as interpreted by the tax commissioners of Georgias 159 counties. The general rule for all exemptions is.

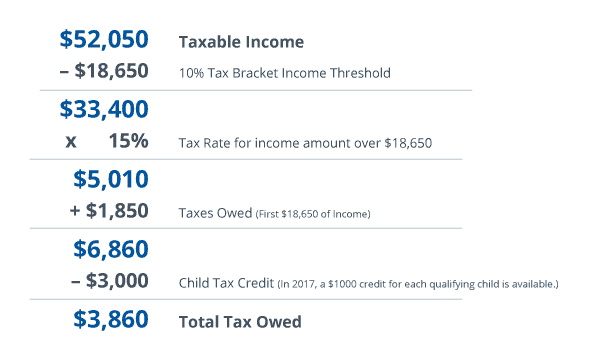

Part 1 - Tax Exemptions. In addition you are automatically eligible for a 10000 exemption in the school general tax category. Property Tax Exemptions Page 6 Taxpayer Bill of Rights Page 11 Property Tax Appeals Page 13 Franchises Page 15 Taxation of Public Utilities Page 16.

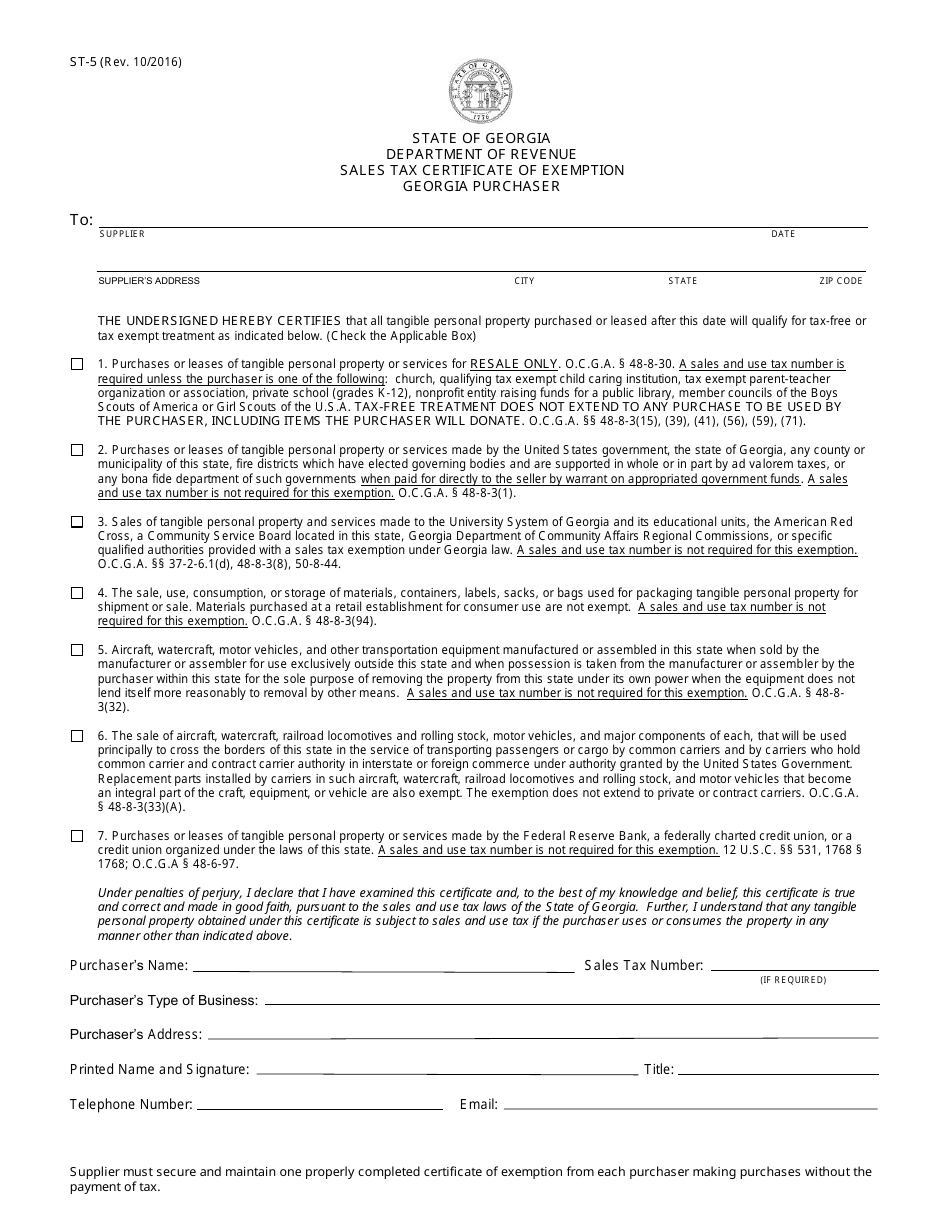

Vehicle Registration - Vehicle owners must renew their. GDVS personnel will assist veterans in obtaining the necessary documentation for filing. Many Georgia counties and municipalities exempt local property tax at 100 for manufacturers in-process or finished goods inventory held for 12 months or less.

Georgias companies pay no state property tax on inventory or any other real or personal property. When applying you must provide proof of Georgia residency. The value of the property in excess of.

County Property Tax Facts. 2010 Georgia Code TITLE 48 - REVENUE AND TAXATION CHAPTER 6 - TAXATION OF INTANGIBLES ARTICLE 1 - REAL ESTATE TRANSFER TAX 48-6-2 - Exemption of certain instruments deeds or writings from real estate transfer tax. Senior Citizen Exemptions From Georgia Property Tax If you are 65 years old or older and your net income the previous year wa s 10000 or less you qualify for a 4000 property tax exemption.

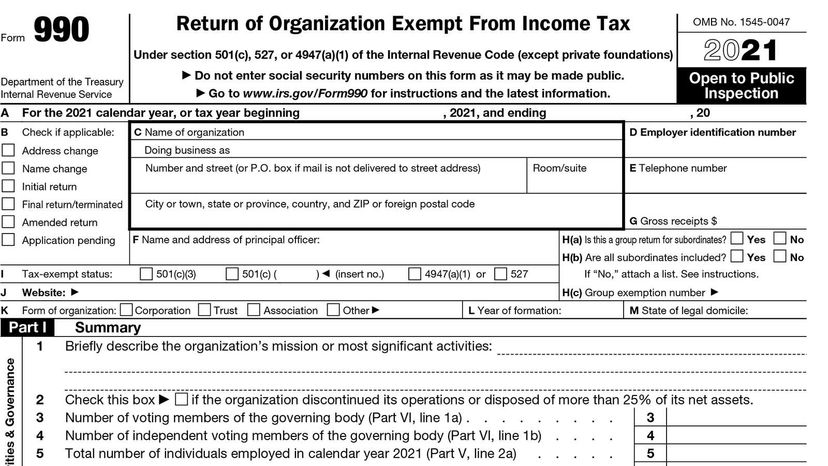

You must apply by April 1st once you have applied and been approved for one of these age exemptions the. Georgia Code 48-5-41 provides an exemption from ad valorem taxes for certain properties based on the ownership and use of the property. State of Georgia government websites and email systems use georgiagov or gagov at the end of the address.

The value of the property in excess of this exemption remains taxable. Apply for a Homestead Exemption. The amount is 93356 during FY 2022 per 38 USC.

This exemption provides tax relief of approximately 60 - 85 dollars per tax year. In Georgia property is required to be assessed at 40 of the fair market value unless otherwise specified by law. This exemption is extended to the un-remarried surviving spouse or minor children.

L- Local Exemptions Classification of partial property exemptions such as homestead exemptions that are local to the county and not applied statewide. Homestead Exemption Chart. All tools and implements of trade of manual laborers in an amount not to exceed 2500 in actual value.

COOPF 0 COOP - Fulton County S1 Regular Homestead HF01 2000 Fulton Homestead Reg S1 Regular Homestead HF01U1 2000 HF01 UE1 S1 Regular Homestead HF01U2 2000 HF01 UE2 S1 Regular Homestead HF01U3 2000 HF01 UE3 S1 Regular. B No public real property which is owned by a political subdivision of this state and which is situated outside. Property Tax Millage Rates.

Items of personal property used in the home if not held for sale rental or other commercial use. The 2020 Basic Homestead Exemption is worth 27360. 1 A Except as provided in this paragraph all public property.

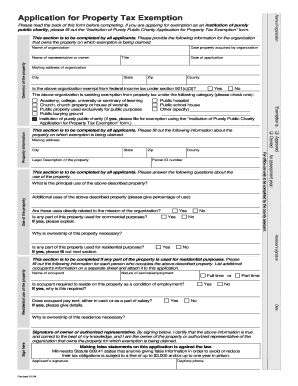

A homestead exemption reduces the amount of property taxes homeowners owe on their legal residence. Property Tax Homestead Exemptions. Other Personal Property Exemptions.

Property Tax Proposed and Adopted Rules. Title Ad Valorem Tax - Motor vehicles purchased on or after March 1 2013 and titled in this State are exempt from sales and use tax and annual ad valorem taxThe taxes are replaced by a one-time tax that is imposed on the fair market value of the vehicle called the Title Ad Valorem Tax FeeTAVT. Each county has different applications and required documents.

Domestic animals in an amount not to exceed 300 in actual value. A homestead exemption can give you tax breaks on what you pay. If youre 62 years old or older and living within a school district and your annual family income is 10000 or less then up to 10000 of your Georgia homes value may be exempt.

While the state sets a minimal property tax rate each county and municipality sets its own rate. Any qualifying disabled veteran may be granted an exemption of 81080 from paying property taxes for state county municipal and school purposes. Cobb County School Tax Age 62 This is an exemption from all taxes in the school general and school bond tax categories.

GA Code 48-5-41 2016 a The following property shall be exempt from all ad valorem property taxes in this state. The owner of the property must be a non-profit organization a copy of your IRS 501c3 award letter will be requested. Code L9-age 70 If you are 70 on January 1 this exemption will be an reduction of all School Tax and Bond.

You must file with the county or city where your home is located. Transitional property conservation use property etc. Basic Homestead Basic Homestead Exemption coded L1.

A homestead exemption can give you tax breaks on what you pay in property taxes. Property Tax Returns and Payment. Property exempt from taxation.

Any qualifying disabled veteran may be granted an exemption of 50000 plus an additional sum from paying property taxes for county municipal and school purposes. Code Count Acres and Assessed Value Each classification for taxable property has a column for Code Count Acres and Assessed Value. The actual filing of documents is the veterans responsibility.

The L1 basic Homestead Exemption is available for application by any homeowner meeting the criteria above. 23 rows CITY OF ATLANTA HOMESTEAD EXEMPTION QUALIFICATION Code. Georgia exempts a property owner from paying property tax on.

Requirement that consideration be shown OCGA.

Every Year We Rank The Best States For Solar Power And The Worst Learn All About State Solar Policy And Incentives Li Solar Power Solar Data Visualization

How To Get A Sales Tax Exemption Certificate In Ohio Startingyourbusiness Com

10 Ways To Be Tax Exempt Howstuffworks

States That Fully Exempt Property Tax For Homes Of Totally Disabled Veterans

How To Get A Wisconsin Sales Tax Exemption Certificate Startingyourbusiness Com

Form St 5 Download Fillable Pdf Or Fill Online Sales Tax Certificate Of Exemption Georgia Purchaser Georgia United States Templateroller

Georgia United States Lgs Homestead Application For Homestead Exemption Download Fillable Pdf Templateroller

Sales Tax Exemption For Building Materials Used In State Construction Projects

New Resident Cobb Taxes Cobb County Tax Commissioner

How To Get A Sales Tax Exemption Certificate In Missouri Startingyourbusiness Com

Minnesota Property Tax Exemption Fill Out And Sign Printable Pdf Template Signnow

Forsyth County Government News Homestead Age 65 Tax Exemptions Can Now Be Filed Online

Solar Property Tax Exemptions Explained Energysage